bexar county tax office property search

Get Property Records from 3 Assessor Offices in Bexar County TX. With your permission we and our partners may use precise.

Understanding Your Bexar County Property Taxes Youtube

For property information contact 210 242-2432 or 210 224-8511 or email.

. You can search for any account whose property taxes are collected by the Bexar County Tax Office. Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers. Enter an account.

Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services. We and our partners store andor access information on a device such as cookies and process personal data such as unique identifiers and standard information sent by a device for personalised ads and content ad and content measurement and audience insights as well as to develop and improve products. Your property tax burden is decided by your locally elected officials and all inquiries concerning your local taxes should be directed to those officials Property Search Data last updated on.

They are maintained by various government offices in Bexar County Texas State and at the Federal level. Bexar County Tax Office. For more information on property values call BCAD at 210-242-2432.

For your convenience the Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check eCheck. Bexar County Assessors Office 3505 Pleasanton Road San Antonio TX 78221 210-335-2251 Directions. Reports Record Searches.

In-depth Bexar County TX Property Tax Information Assess all the factors that determine a propertys taxes with a detailed report like the sample below. See Property Records Deeds Owner Info Much More. You may contact one of the following e-filing providers to electronically file documents with our office.

100 Dolorosa San Antonio TX 78205 Phone. Bexar County Assessor 233 N Pecos La Trinidad San Antonio TX 78207 210-335-6585 Directions. The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. Monday - Friday 745 am - 430 pm Central Time. For your convenience the Bexar County Clerks Office is pleased to announce its implementation of electronic recording.

Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. Property Tax Overpayments Search. Bexar County Tax has four locations in San Antonio including one main headquarters branch.

100 Dolorosa San Antonio TX 78205 Phone. They are a valuable tool for the real estate industry offering both buyers. County tax assessor-collector offices provide most vehicle title and registration services including.

The amount you paid for your used vehicle. Get In-Depth Property Reports Info You May Not Find On Other Sites. Search for any account whose property taxes are collected by the Bexar County Tax Office for overpayments.

2022 and prior year appraisal data current as of Aug 5 2022 724AM. Electronic Filing of Real Property Documents. Aug 23 2022 20608 AM.

The united states tx tax assessor property tax code requiring taxing units tax search tabs above. After locating the account you can pay online by credit card or eCheck. Search Any Address 2.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Albert Uresti reminds Homeowners that applying for a Residential Homestead Exemption is free with the Tax Office. Search for records and reports of.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Property owners are advised to pay their taxes online or by phone at 888-852-3572 using an electronic check free or a line of credit which has a. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County.

Rates will vary and will be posted upon arrival. Reports Record Searches. Resources and searches to help you find the information you need.

Property Tax Account Search. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide. Please follow the instructions below.

San Antonio TX 78283-3966. Bexar County Assessor 8407 Bandera Road San Antonio TX 78250 210-335-6435 Directions. 211 South Flores Street San Antonio TX 78207 Phone.

Collector does not set tax rates or set property values. Simply type the address in the search box below to perform a quick property tax lookup and access relevant Bexar County TX tax information instantly. For website information contact 210 242-2500.

Electronic payments will be pending until it clears from your bank account. Truth-in-taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to. Non-fee License Plates such as Purple Heart and Disabled Veterans.

Protest status and date information current as of Aug 23 2022 112AM. Ad Receive Bexar County Property Records by Just Entering an Address. The Bexar County Appraisal District BCAD sets property values and is a separate organization from the Bexar County Tax Assessor-Collectors office.

Welcome to the Bexar Appraisal District is responsible for appraising all real and personal. Search property by name address or property ID. Change of Address on Motor Vehicle Records.

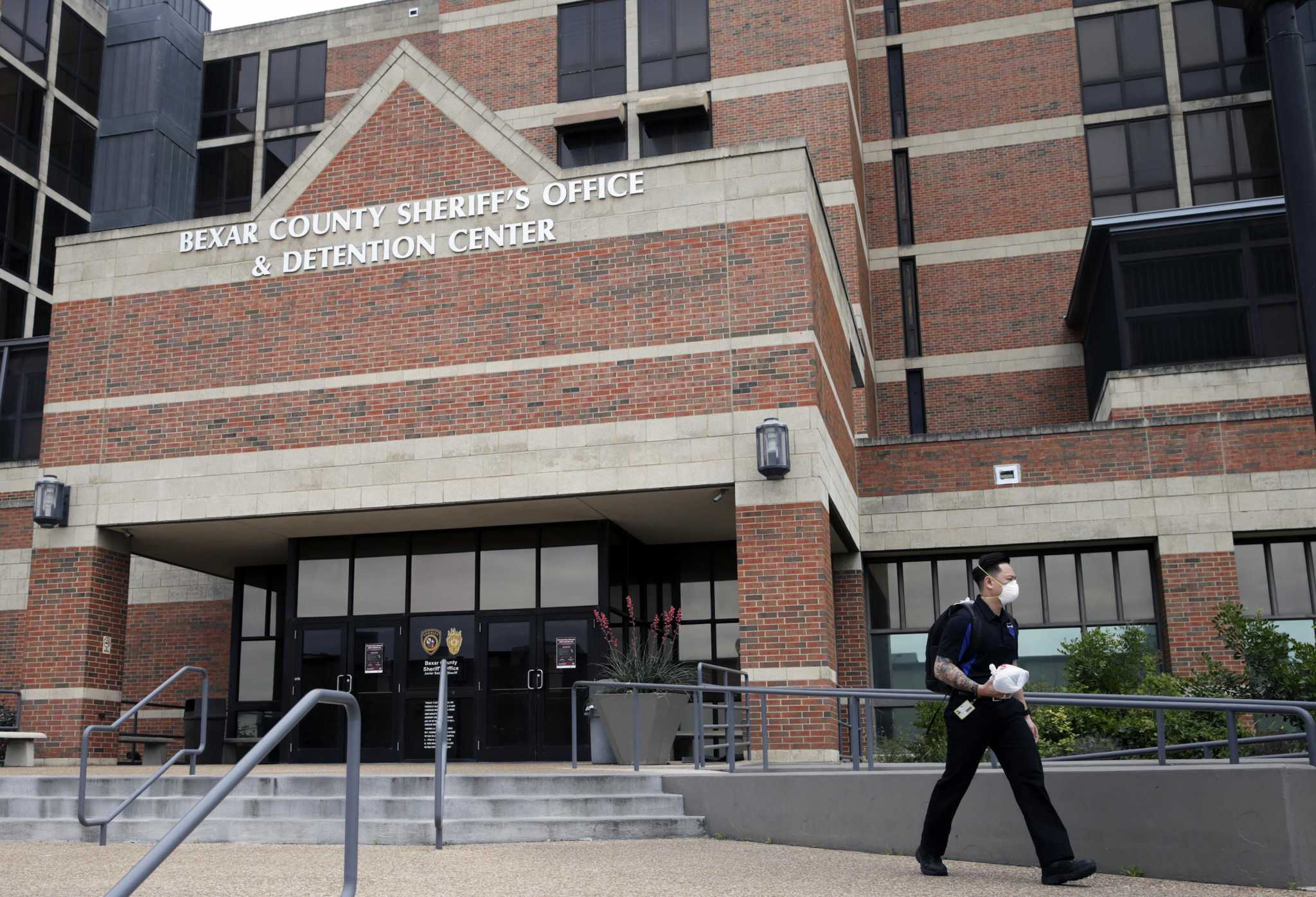

Final processing may take several days. City of San Antonio Property Taxes are billed and collected by the Bexar County Tax Assessor-Collectors Office. BCSO Jail Activity Report.

Search For Bexar County Online Property Taxes Info From 2022. For information on obtaining a Marriage License please contact the Bexar County Clerks Office at 210 335-2221 or visit the.

15 000 Homeowners In Bexar County Eligible For Help On Delinquent Property Taxes Kens5 Com

Everything You Need To Know About Bexar County Property Tax

Deadline Arrives For Property Appraisal Protests In Bexar County Tpr

Bexar County Commissioners Approve Slightly Reduced Tax Rate For 2022

Bexar County Commissioners Meet Virtually For First Time

What You Need To Know About Protective Orders In Bexar County Ksat Explains

Bexar County Building Use Bexar County Tx Official Website

News Flash Bexar County Tx Civicengage

Bexar County Commissioners Approve Funding For Uh Public Health Division Homestead Property Exemption Tpr

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Real Property Land Records Bexar County Tx Official Website

Access To Food Disinfectant Improves At Jail Amid Coronavirus Outbreak Some Inmates Say

Property Tax Information Bexar County Tx Official Website

High Bexar County Property Values Prompt Residents To Learn The Art Of Protesting Or Find A Consultant

Property Tax Information Bexar County Tx Official Website

San Antonio Officials Promote Assistance Amid Surge In Property Appraisals Community Impact

Funding Shortfalls Hamper Bexar County Courts Tpr

Bexar County Commissioners Approve Delorean Tax Break Extend Burn Ban During Drought Tpr