property tax in france 2020

The planned measures will see an initial 30 reduction in your. So if youre selling a.

For example If you are buying a primary home in.

. Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. Over the past two years. Exactly how much CFE you can.

Homeowners in France have previously needed to pay local residence tax a local communal tax levied on whoever is the occupant of a property on 1 January each year. Hence property tax was paid. June 12th closing date for tax declarations done on paper.

For 2020 income the latest declared this ceiling was 11120 for a single person 17058 for a couple and a supplement of 2969 for any dependent. It is payable by the individual who owns the property on the 1st. More households will be exempt from the taxe dhabitation this year as the gradual abolition of the tax continues.

Real Estate Wealth tax and Succession Tax in France. This French housing tax deemed unfair by President Macron is set to be abolished for up to 80 of households by 2020. This relates to taxes owed for 2019 and anyone resident in France from April 2019 and onwards needs to fill in a return.

Tuesday 10 November 2020. So this year 2020 you will be declaring according to your situation between 1 January 31 December 2019. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary.

Unmarried couples should complete separate tax returns. Early property tax es which were first implemented in feudal times were levied primarily against land. This French housing tax deemed unfair by President Macron is set to be abolished for up to 80 of households by 2020.

So the difference between the price you bought it for and the price you sell it for. Once an individual or group owns a property in France whether built or not they become liable for the land or property tax. The good news is that many property owners pay too much CFE and are entitled to a refund.

The current threshold of 1300000 for the IFI real estate wealth tax will stay in place for 2020 with no changes to the scale rates of tax. Its made up of a flat income tax rate of 19 plus 172 in social charges. The tax typically amounts to between 100 1500.

The tax typically amounts to between 100 1500. 29 rows August 6 2020. The French taxe foncière is an annual property ownership tax which is payable in October every year.

Buying Property In France As A Foreigner 2021 Guide Wise Formerly Transferwise

Taxe D Habitation French Residence Tax

Dentons Global Tax Guide To Doing Business In France

French Taxes I Buy A Property In France What Taxes Should I Pay

![]()

Property Tax Advisory Services Deloitte Us

Peter Flynn On Twitter This Kind Of Data From An The Oecd Must Be Very Upsetting To All Our Left Wing Nutters No Wonder They Want To Eliminate Property Tax Water Charges

Corporate Tax Laws And Regulations Report 2022 France

Selling A French Property What Happens After Brexit Lawskills

Seoul Studying To Ease Property Tax Hovering Above Oecd Average Pulse By Maeil Business News Korea

Where Do People Pay The Most In Property Taxes

Like Kind Exchanges Of Real Property Journal Of Accountancy

American Citizen Relocating To France What Taxes Will You Pay Cabinet Roche Cie

Taxes In France A Complete Guide For Expats Expatica

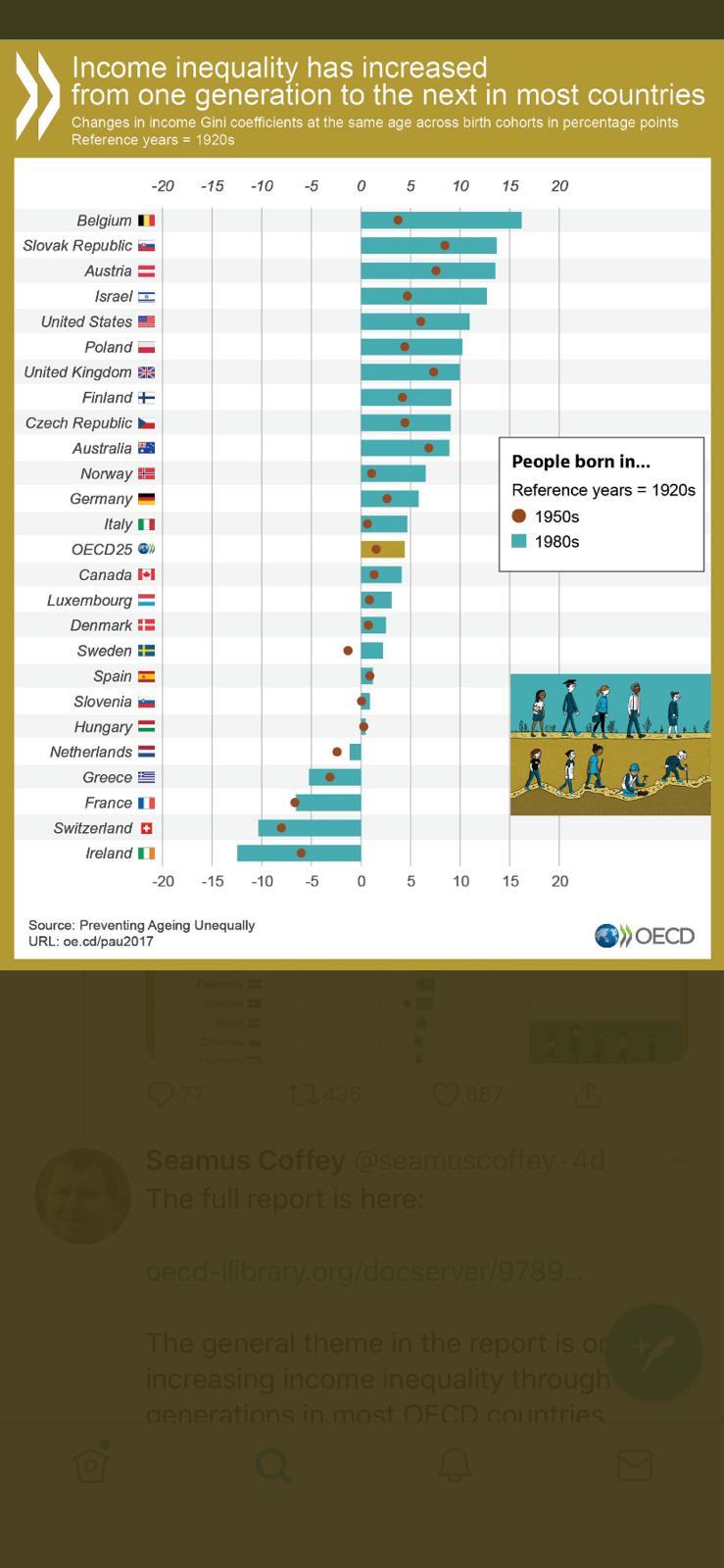

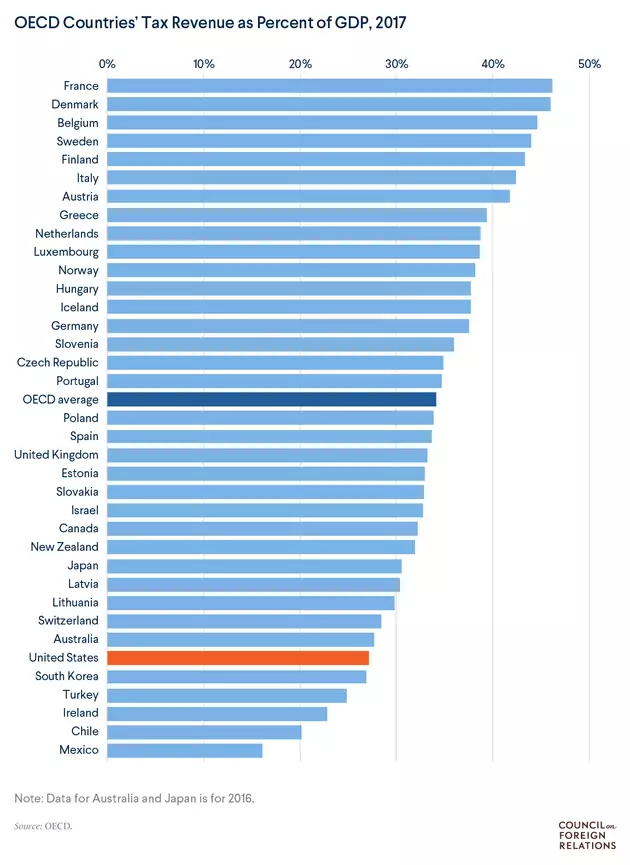

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

59 257 Taxe Fonciere Images Stock Photos Vectors Shutterstock

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Paying Property Tax In France Here S Your Full Guide Wise Formerly Transferwise